Money Talk: Making a Plan

Hello, and happy new year! I hope you don't mind, I took a couple of weeks off to relax, focus on work, and just generally get my life together. The new year is the perfect time for that, which is probably why I love it so much. It's so refreshing and inspiring to begin a new year (and a new planner!). Now, I'm not usually one for making new year's resolutions (I believe in constantly striving for self-improvement), but this year I decided to make a few goals for myself. Here's where most people go wrong with resolutions: they make goals, and that's it. One of my favorite motivational quotes says it best—

So, after I made the list of goals I want to achieve by the end of 2014, I started planning how to get there. As a newly employed college graduate, one of my goals involves creating more financial stability. Between moving expenses, the slightly higher cost of living here in Texas, and settling into my apartment, my savings account has not increased by nearly as much as I would've liked it to. To help determine where my money was going each month (Target and Jimmy Johns, guilty), I created a budget spreadsheet on Google Drive so that I could access it at home or work, or anywhere on my phone with their handy app(click on the photo to see it larger). I broke up the spreadsheet into categories, and then used the "Function" feature to set the gray row at the bottom to calculate the sum of each category, and then to calculate the entire sum (on the right). I entered in a list of all the bills I pay each month (contribution to my savings account included!), which is really helpful in making sure that I remember to pay all of them. I also keep a note of how much I actually have coming in each month, after medical insurance and retirement fund contributions, to reference if I need it. Try making a budget of your own!

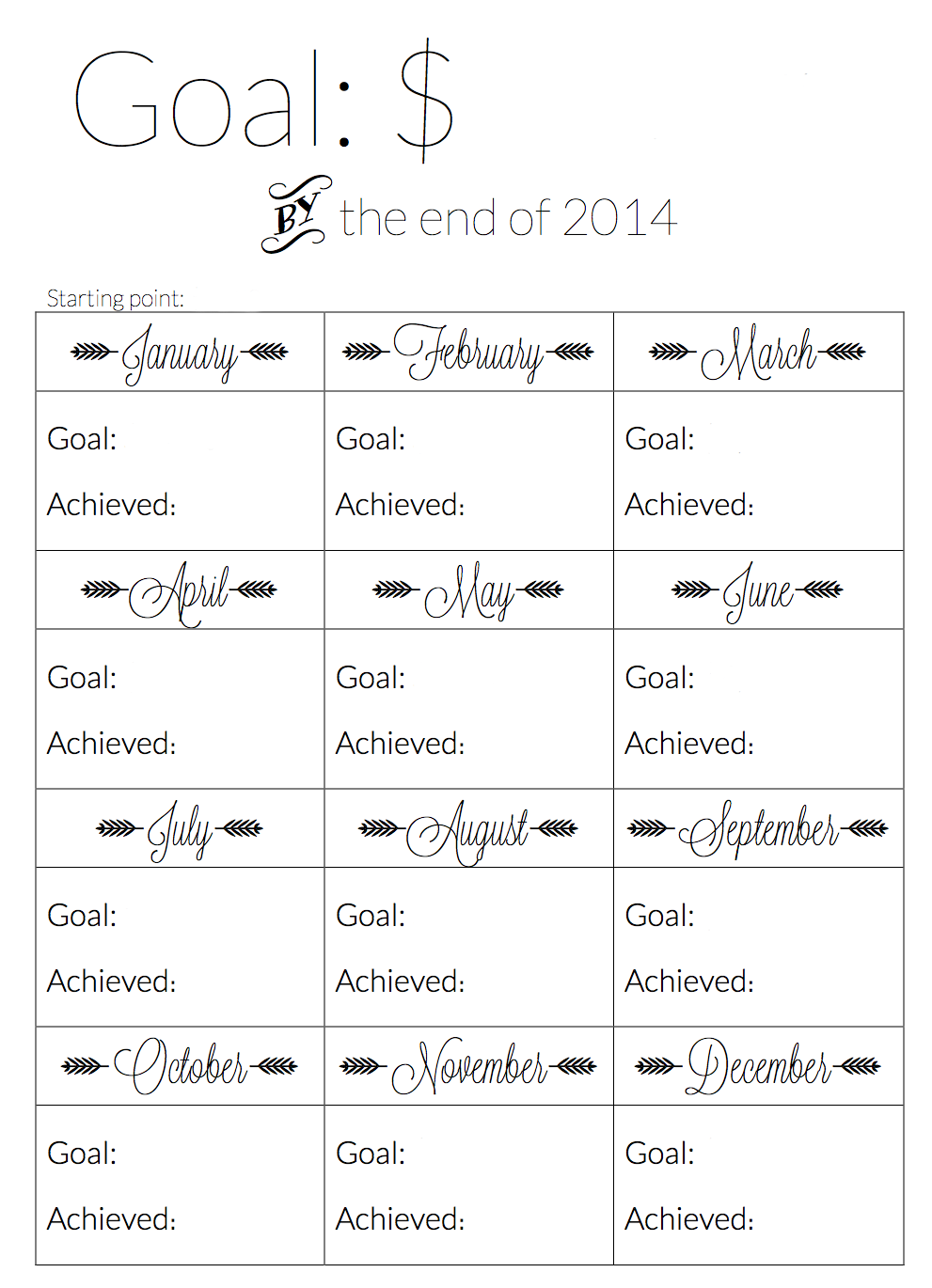

My main financial goal for this year is to reach a set amount in my savings account. It's just good common sense to have a "safety net" for emergencies or unforeseen expenses, and to have set aside for future expenses (like weddings, new cars, mortgages, "adult" stuff:) ). To make a plan for achieving my goal, I took my desired end amount and divided it by 12 (one contribution per month), and then compared it to my current budget to determine if that amount was doable. Once I settled on a monthly contribution amount, I added it to my budget (see above!) and created the table below to help visualize my progress and keep me on track. I typed in my goal amount, starting point (what's already in my savings account), and goals for each month. At the end of each month, I'll write in the actual amount in my account.

Download my chart here or make your own (hello Microsoft Word), and start planning for your own goal! If you're looking for more (totally doable) financial tips, here are a couple good articles from The Everygirl. What are your goals for this year?